Popular Articles

Trey Kulley Majors Biography, Family and Career Highlights in 2024

Finding fresh faces in the fashion and modeling world that stand out can be tough. People often look for someone...

Discover the Historical Events and Famous People Born on May 8

May 8 is a day with many important events in history. Some of these events changed the world and how...

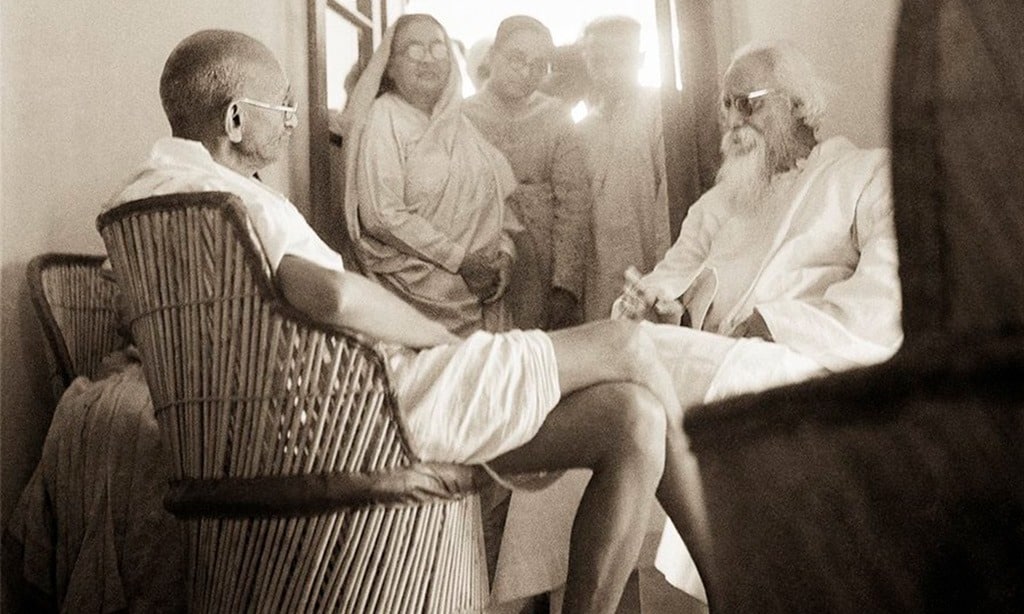

Tagore and Gandhi Friendship that Shaped India’s Freedom Struggle

Today, May 8, 2024 (25 Boishakh, 1431) is the 163rd birthday of Rabindranath Tagore. His birthday is celebrated as “Rabindra...

Is It Legal To Get Spotify From Jojoy in 2024? If Not, Then What?

Are you tired of ads breaking into your music vibe on Spotify? And are you hunting for a way to...

7 Incredible Benefits of Yimusanfendi Meditation and Possible Side Effects

Feeling stressed and out of balance has become a common part of life for many. It’s hard to find peace...

The Truth About Zach Bryan’s Height With Complete Biography in 2024

Everyone is talking about Zach Bryan and how tall he is. Why does it matter so much? Fans are super...

Latest Articles

Rabindra Jayanti 2024: Celebrating the Life and Legacy of Rabindranath Tagore

Rabindra Jayanti is an annual festival celebrated in India and Bangladesh to honor the birth anniversary of Rabindranath Tagore, one...

Travis Kelce Joins FX’s ‘Grotesquerie’ by Ryan Murphy: A Must-See!

NFL star Travis Kelce is making waves in Hollywood as he secures his first significant acting role in Ryan Murphy’s...

Khloe Kardashian Reacts to Kim’s Corset at 2024 Met Gala

The 2024 Met Gala, held on May 6, was a night to remember for fashion enthusiasts worldwide, and the Kardashian-Jenner...

OpenAI Shuts Down Book Collection Used for AI Training

In a stunning revelation that could have far-reaching implications for the future of AI development, newly unsealed court documents have...

Trey Kulley Majors Biography, Family and Career Highlights in 2024

Finding fresh faces in the fashion and modeling world that stand out can be tough. People often look for someone...

Exciting Rumor: ChatGPT Search Engine Set to Debut Next Week!

The world of search engines could be on the brink of a major shake-up. Rumors are swirling that OpenAI, the...