Popular Articles

An In Detail Case Study of Pikruos With It’s Benefits and Success Story

Running a business is hard. You might feel lost or overwhelmed by the choices out there. Pikruos is here to...

Sonny Side’s Wife Still a Mystery to the Fans [What We Know So Far]

In a world brimming with love stories, the tale of Sonny Side and his wife stands out, shrouded in mystery...

A Complete Image Guide and User Experience on SimpCityForum in 2024

Are you feeling lost in the vast world of SimpCityForum? You’re not alone. Many users find it tough to get...

Tiffany Pesci Age, Height, Wiki, Instagram, Net Worth, and More in 2024

Finding information online can sometimes feel like looking for a needle in a haystack. With so much out there, it’s...

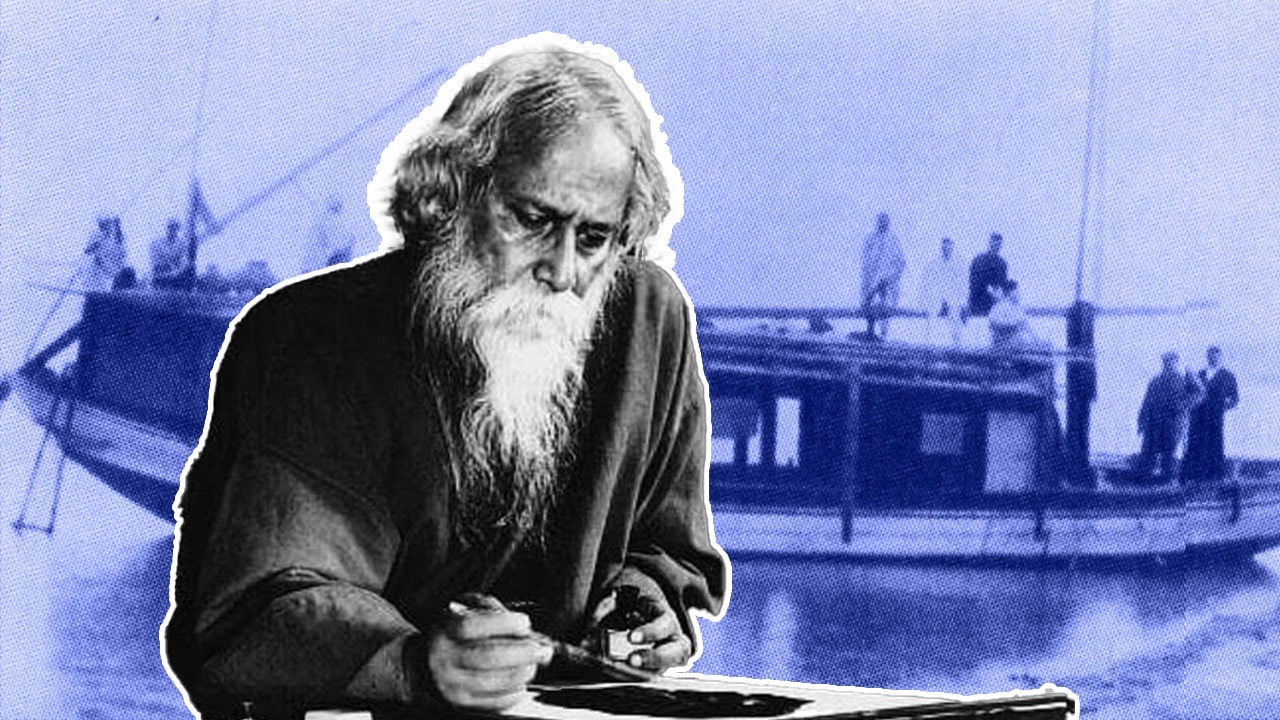

Rabindranath Tagore’s Memories With Nagor River

“I used to sail from Padma to Ichhamoti, from Ichhamoti to Boral, Huro Sagar, Chalan Beel, then Atrai, Nagor River,...

Trey Kulley Majors Biography, Family and Career Highlights in 2024

Finding fresh faces in the fashion and modeling world that stand out can be tough. People often look for someone...

Latest Articles

An In Detail Case Study of Pikruos With It’s Benefits and Success Story

Running a business is hard. You might feel lost or overwhelmed by the choices out there. Pikruos is here to...

Susan Buckner, ‘Grease’ Star Who Played Patty Simcox, Dead at 72

The entertainment world is mourning the loss of Susan Buckner, the actress who brought the spirited cheerleader Patty Simcox to...

Apple Unveils iPad Pro with World’s Most Advanced Display & M4 Chip (Apple Pencil Pro)

Apple has pulled out all the stops with its latest iPad Pro, unveiling a complete redesign that pushes the boundaries...

Sonny Side’s Wife Still a Mystery to the Fans [What We Know So Far]

In a world brimming with love stories, the tale of Sonny Side and his wife stands out, shrouded in mystery...

A Complete Image Guide and User Experience on SimpCityForum in 2024

Are you feeling lost in the vast world of SimpCityForum? You’re not alone. Many users find it tough to get...

Tiffany Pesci Age, Height, Wiki, Instagram, Net Worth, and More in 2024

Finding information online can sometimes feel like looking for a needle in a haystack. With so much out there, it’s...